Care Association is developing an affordable housing technology solution, a platform to enable homeowners with vacant rooms or units to offer housing to lower-income tenants who tell their stories on the CareForUs.us site. We have found that many homeowners wish to help those in need of affordable housing yet don’t know where to find tenants who are suitable for them.

The Care For Us site will also enable donors to search for, choose, and give goods and services to individuals and charities in need. Goods provided through the program are items that assist individuals in achieving a U.S. standard of living or quality of life and nonprofits in procuring supplies and equipment for their charitable operations. Services may be educational, legal, financial, or health-related. Beneficiaries are verified by Care Association as “in need” based on financial criteria and knowledge of individuals and organizations.

When I first started this nonprofit, I was providing nonprofits with equipment and supplies. I was also providing pro bono emotional regulation care. The website idea came after talking with people about their hesitance getting rid of things that are meaningful to them. Knowing who benefits from donations gets lost when donating to thrift stores. How can we find recipients who would appreciate them? Others mentioned their desire to help people, but didn’t have a way to help without committing to a program. Care For Us would enable pro bono services directly to people in need. But I realized that lack of affordable housing is probably the cause of most low-income stress. If the Care For Us site can connect donors to beneficiaries, why not connect landlords to prospective tenants?

The Care For Us Demo

Today, the Care For Us demonstration website is under construction. We need a demo in order to raise funds, and to show that the Care For Us site will work. Results will enable us to effectively apply for grants. For this demo, I wanted at least five participants who needed affordable housing to be “users” and beneficiaries of the site. I put together an online form where prospective beneficiaries could upload photos and write their stories. I learned that few people are willing to allow someone else to choose housing for them, and that those who struggle with low income do not want to broadcast their needs. Our society looks down on people with low income, leading to shame and embarrassment. Only one out of ten people invited to become participants of the demo completed the form.

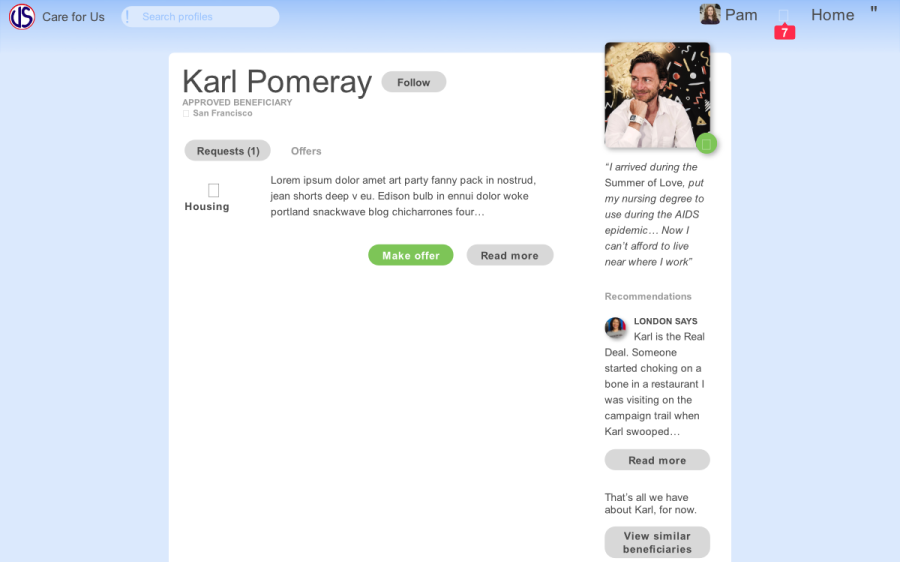

The demo site is meant to be a working prototype. So far, the participant who completed our form has a live page hosted at careforus.us. We have been reaching out to landlords and property managers and will soon place an ad to find the participant’s family a home.

Volunteers Are the Heart of Care Association

While we wait for more people to sign up for our demo, there is a lot of work to do. I have been building the demo site by typing out the html markup. It’s not super pretty, but it functions. One volunteer is working on our technology infrastructure with Salesforce at its center. Another volunteer has written an article to boost marketing. Soon we will look for a web architect to plan construction of the launch site. Since we were unable to raise enough funds to hire an engineer, I will be coordinating site construction with volunteers. We had an original beta launch date of January 2019, but it will be much later than that. I am also a volunteer, enabled by loved ones to carry on with this venture. This means 100% of funds received will go toward operations and housing assistance. Currently, we have a GoFundMe campaign to raise a security deposit to help our participant find a home.

Six months ago, when someone told me that nonprofits take a long time to make accomplishments, I thought that I would be the exception and be able to launch our project expeditiously. Now humbled with a fourth revision to our business plan, I still have hope to make this world a better place for some.